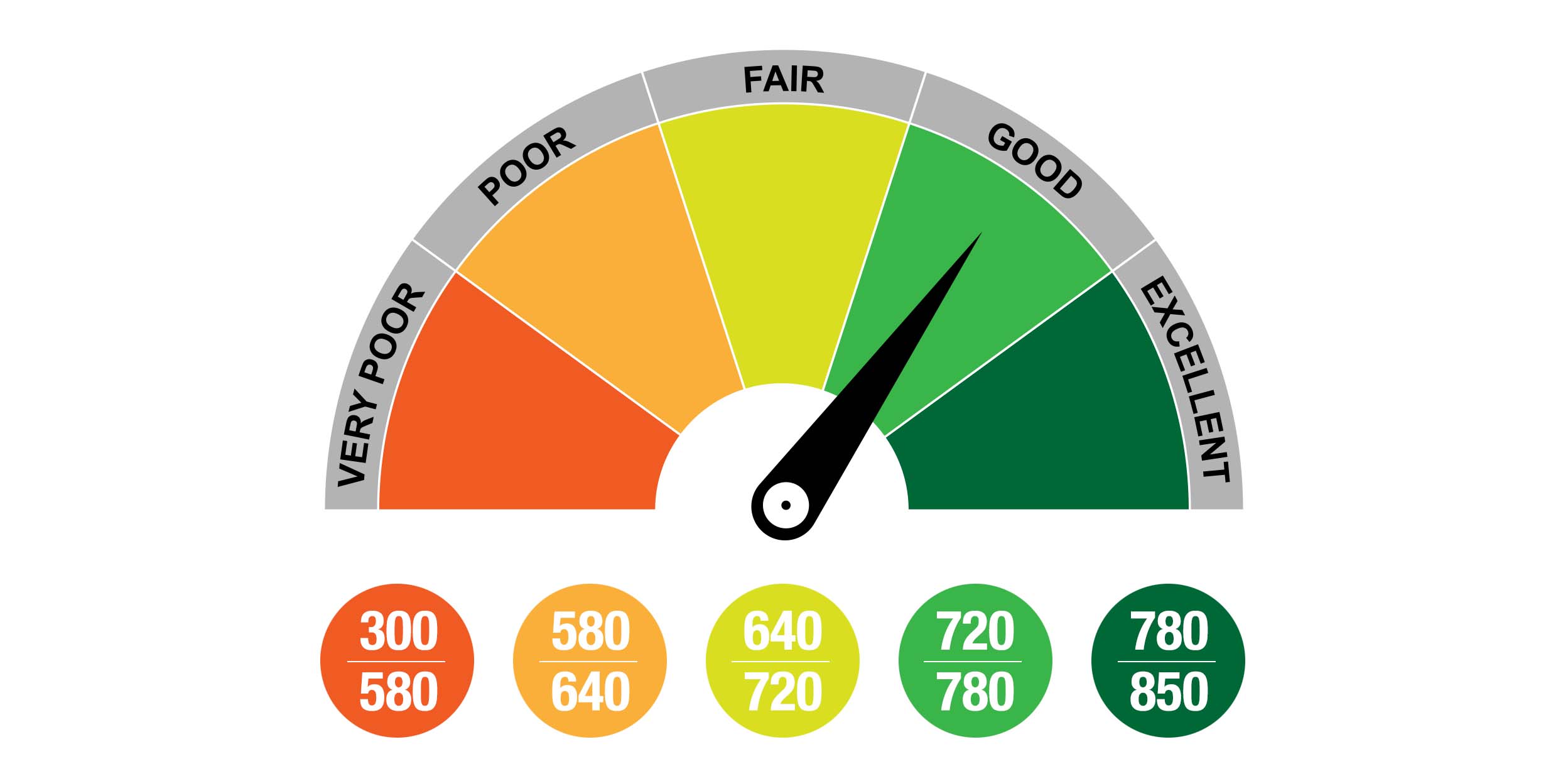

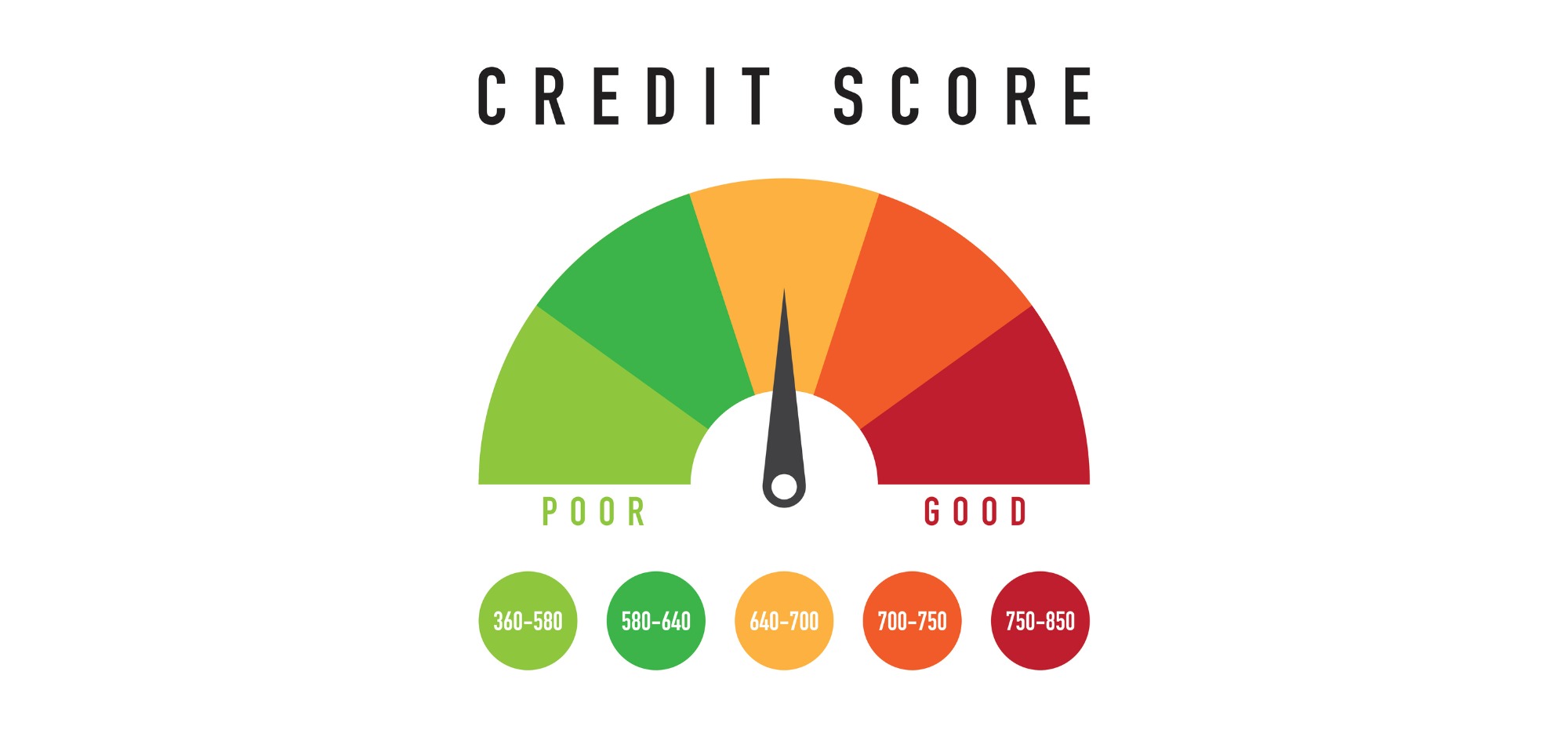

People considering a large purchase may be concerned about their credit score and how it might affect their eligibility for a loan. Don’t despair; there are ways to raise your credit score. Try following some of these ideas to bring your credit score up.

Many people don’t realize how important their credit score is, especially if they’re just starting out. Like your social security number, however, your credit score is intrinsically linked to your name for your entire adult life. If you want to borrow money of any amount the creditor will check your credit rating.

* Each year, order copies of your credit report and check it for errors. Knowing what is in your report will enable you to get any errors corrected which could increase your score dramatically. If you have extenuating circumstances concerning anything on your credit report, you have the ability to write a letter explaining your situation and have that included in your report. Depending upon the reason, this information could encourage a creditor to approve a loan request.

* Pay your bills on time. Each time you are late on payments your credit score is adversely affected, often within two months after the payment is missed. The reverse is also true; if you pay on time your score goes up; however, it can take six to twelve months for the good reports to be added.

* Avoid opening accounts you won’t use. No initial discount offered for opening an account is worth the potential black mark on your credit score. All you have to do is to keep in your mind that is very crucial to get the best result in these things very easily and accurately. There are a lot of things that are very required to get the best result. Emergency loans with minimal interest is the best thing that will help you a lot

* Transferring balances is risky business, so try to pay your credit cards off rather than transferring the balance to a lower rate card. The reason being, transfers may change the ratio of credit owed and open credit lines which hurts your credit score.

* If you do use credit cards, pay them off every month or use them sparingly. Your goal is to have as small a balance as possible when compared to available credit. Keeping the balance owed below 25% of the total available is good for your credit score.

* Choosing to close older accounts you no longer use could have a negative effect on your credit rating. Creditors want to see a long credit history, so you may want to leave older accounts open – at least until you’ve received the loan you’re seeking.

* Do everything you can to avoid having to file for bankruptcy. Even though you may have an immediate reprieve, in the long run it will be disastrous for your credit score.

* If one or more of your credit accounts is past due, bring them current as soon as you can.

Ultimately, if you know you’re going to have problems making payments at any point, it is better to call your creditor immediately and discuss your situation with them. They may be able to reduce your interest rate or postpone several payments. The important thing is to let your creditors know so you can work with them to keep your credit in good standing.